-

Urbanisation in India: Definition, Trends, Challenges and Sustainable Solutions

Urbanisation is one of the most powerful socio-economic transformations of the 21st century, reshaping how people live, work, and interact. In India—home to the world’s largest population—urbanisation is rapidly redefining our social landscape, economic potential, governance frameworks, and sustainability challenges. What is Urbanisation? Urbanisation refers to the process where a growing share of a country’s…

Written by

-

Understanding Public Policy and Its Role in Development

Introduction Every visible outcome of governance—education systems, healthcare services, infrastructure, climate action, poverty alleviation, or digital transformation—is shaped by public policy. While the term “policy” is frequently used, its depth, scope, and transformative power are often underestimated. Public policy is not merely a government decision; it is a structured response to public problems, anchored in…

Written by

-

Output vs Outcome: Meaning, Differences, and Their Role in Scientific Project Evaluation

Introduction In development planning, governance, and public policy, terms like output and outcome are frequently used—but often misunderstood or used interchangeably. This confusion leads to weak project evaluation, misleading success claims, and poor policy learning. Understanding the difference between output and outcome is crucial for: This blog explains these concepts clearly and simply, using real-life…

Written by

-

Why the World’s Top Universities List (2026) Has No Indian Institutions?

Introduction Every year, global university ranking bodies release their latest lists measuring academic excellence, research impact, global reputation, and other critical indicators. The QS World University Rankings 2026 — one of the most authoritative global lists — was recently published, yet not a single Indian university made it into the top 100. In this article,…

Written by

-

Ultimate Guide to Berkshire Hathaway: The American Financial Titan

Introduction: What Is Berkshire Hathaway? Berkshire Hathaway Inc. is one of the world’s largest and most respected multinational conglomerates — a company that owns dozens of distinct businesses and holds major investments in others. Originally a struggling textile firm, it is today a powerhouse in insurance, railroads, energy, manufacturing, and investment portfolios. Berkshire’s story is…

Written by

-

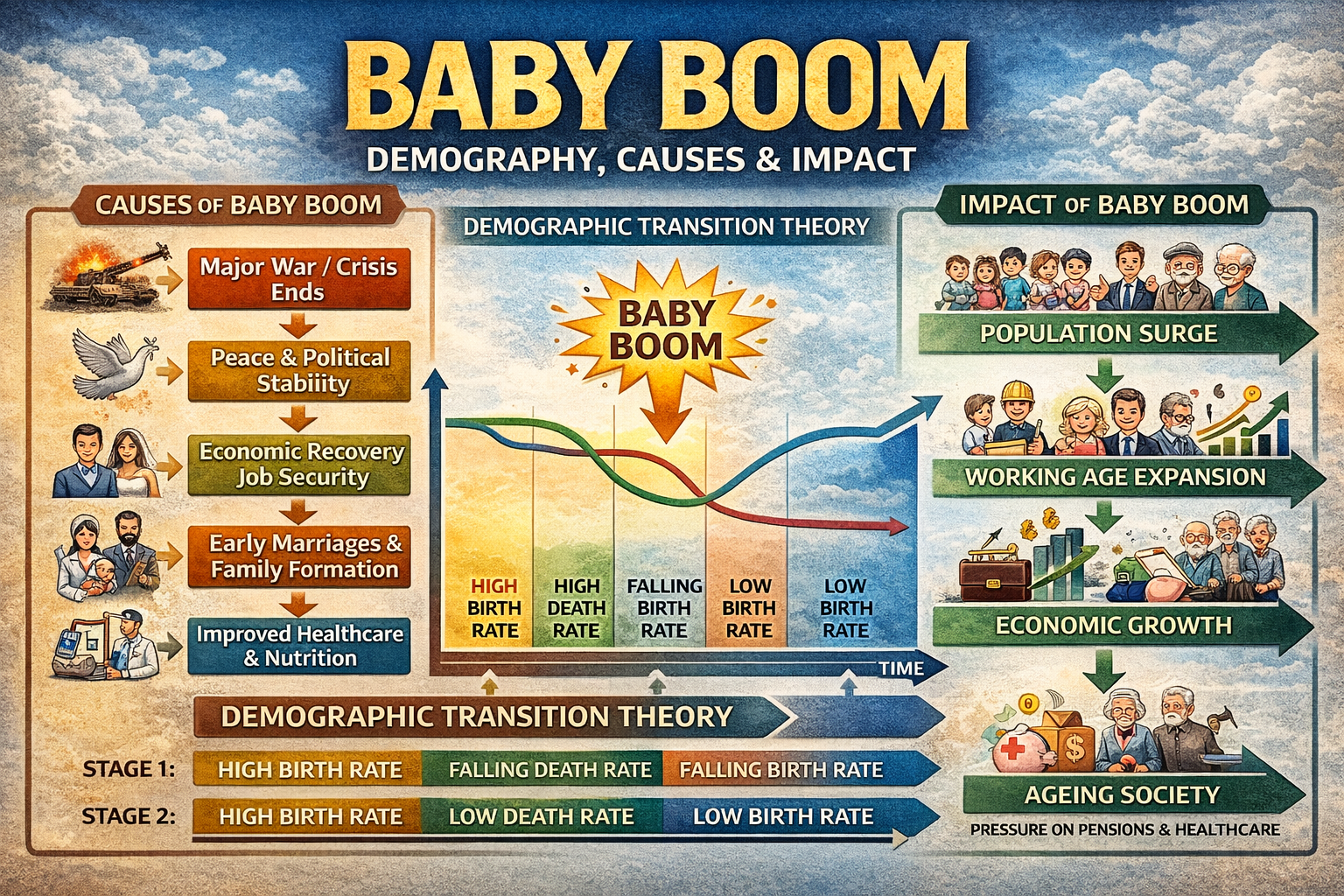

Baby Boom: How a Population Surge Shaped Modern Demographic History

Introduction Population growth does not occur randomly—it follows social, economic, and historical rhythms. One of the most influential population phenomena of the modern era is the Baby Boom, a sudden and sustained rise in birth rates that reshaped societies, economies, and global demographics. From post-war prosperity to changing family structures, the baby boom played a…

Written by

-

Robert Kiyosaki: The Man Who Redefined Wealth, Assets, and Financial Freedom

Introduction Robert T. Kiyosaki is one of the most influential personal finance educators of modern times. Best known as the author of Rich Dad Poor Dad, Kiyosaki challenged traditional beliefs about money, education, jobs, and investing. Loved by millions and criticized by many, his ideas sparked a global conversation on financial literacy and wealth creation…

Written by